Simplii Financial is a Canadian no-fee online bank owned by CIBC, one of Canada’s Big Five banks. It offers many of the products we’ve come to expect from online-only banks such as no-fee banking, high-interest savings accounts, credit cards, etc. Being an online bank means Simplii does not have any branch locations, but as a division of CIBC, Simplii clients can withdraw or deposit cash or cheques at any CIBC ATM for free.

If you would like a more in-depth look at Simplii Financial, you can check out our review here.

In this article, we will be detailing the steps to open a Simplii Financial no-fee chequing account and a high-interest savings account.

In This Article

Highlights

- Simplii Financial is a no-fee online-only division of CIBC

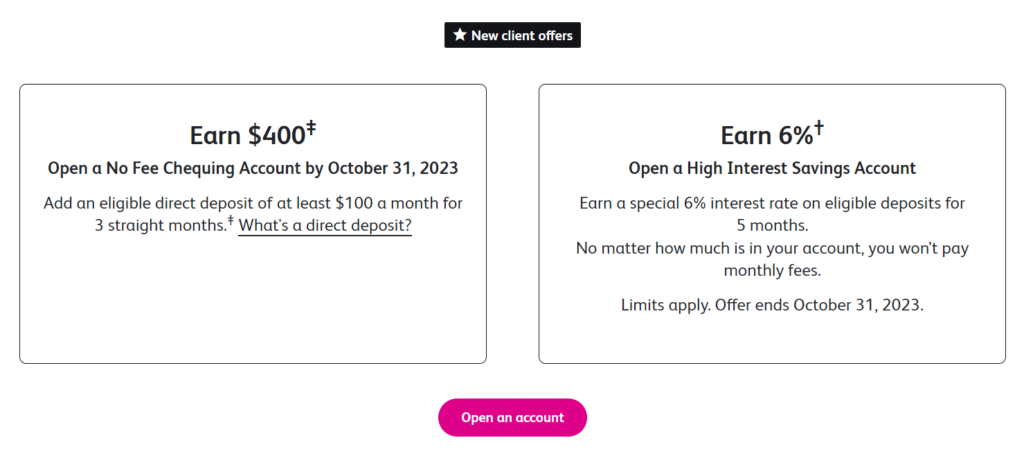

- Simplii is currently offering 6% interest for 5 months on eligible deposits for new customers when they open a high-interest savings account

- Simplii is also offering new customers $400 when they open a no fee chequing account

- To be eligible, you need to be a resident of Canada (excluding Quebec) and be over the age of majority in your province

- Things to have on hand:

- Social Insurance Number (SIN)

- 1 piece of ID

- mobile device with a camera (if you are using a desktop computer)

- The online application process is fast and straight forward

Why Have Another Savings Account?

Now, you may be wondering why I am opening yet another savings account and the reason is simple. I am not opposed to moving my money around to get the best deals. If my money is just sitting there not making me returns, I move it elsewhere.

Currently, Simplii is offering 6% interest on eligible deposits for 5 months and $400 to new customers.*

To get the $400, you must add an eligible direct deposit of at least $100 a month for 3 months in a row. This should be easy enough if you are an employee getting paid regularly or getting deposits on a regular basis.

Previously, I was getting 5% from Tangerine but that promotion ended and they have not offered a better interest rate than their base 1% for their savings account (I asked). The Tangerine chequings account base interest is even worse at 0.01%…

Don’t get me wrong, I actually quite like Tangerine. I use them for my everyday banking but their base interest rates are very lacking without promotional rates. We have a review here on Tangerine and why I still prefer them for my day to day banking.

Considering there are so many options for high-interest savings accounts that are offering 4% or more, it is a no brainer to park my extra cash where I can maximize my returns.

I talk about the pros and cons of high-interest savings accounts and why I think everyone should have one here if you are interested.

*Please note, the offers may have changed depending on when you are reading this. Please check the Simplii Financial website for the most up-to-date offers.

Steps to Opening a Simplii Financial Account

1. Complete the application

** Click on the arrows for more details and images

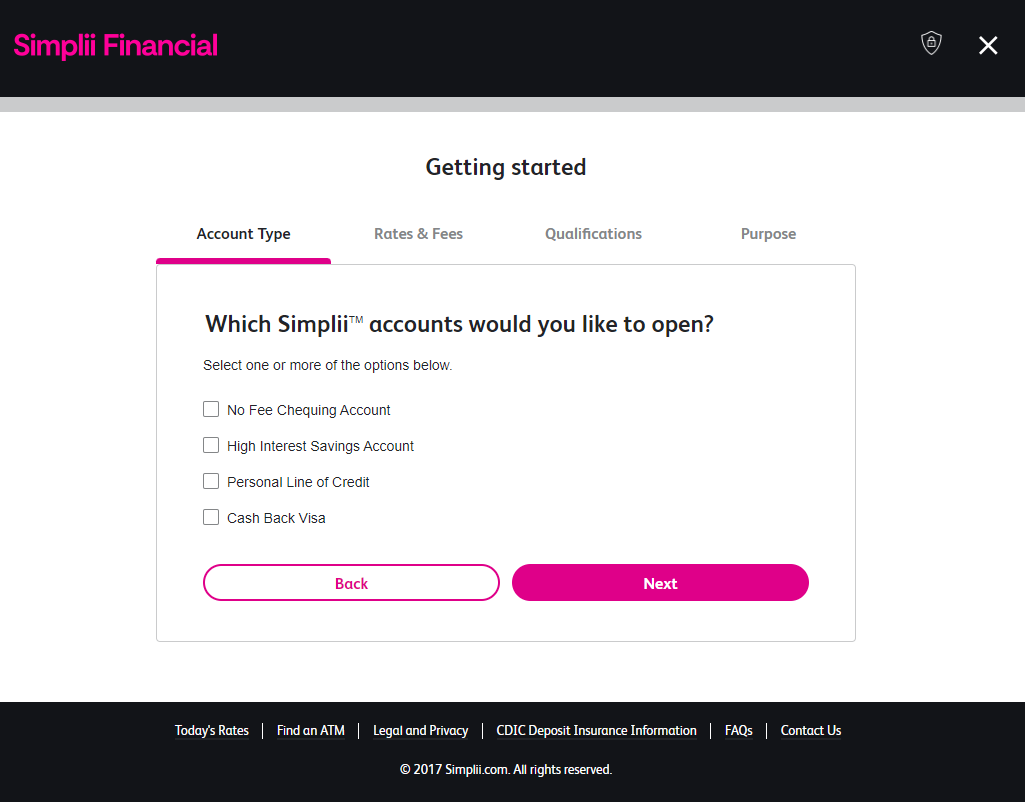

1. Choose the type of account(s) you want to open

a) I just chose the Chequing and Savings Accounts for now

b) It skipped over the Rates & Fees because the Chequing and Savings Accounts have no fees

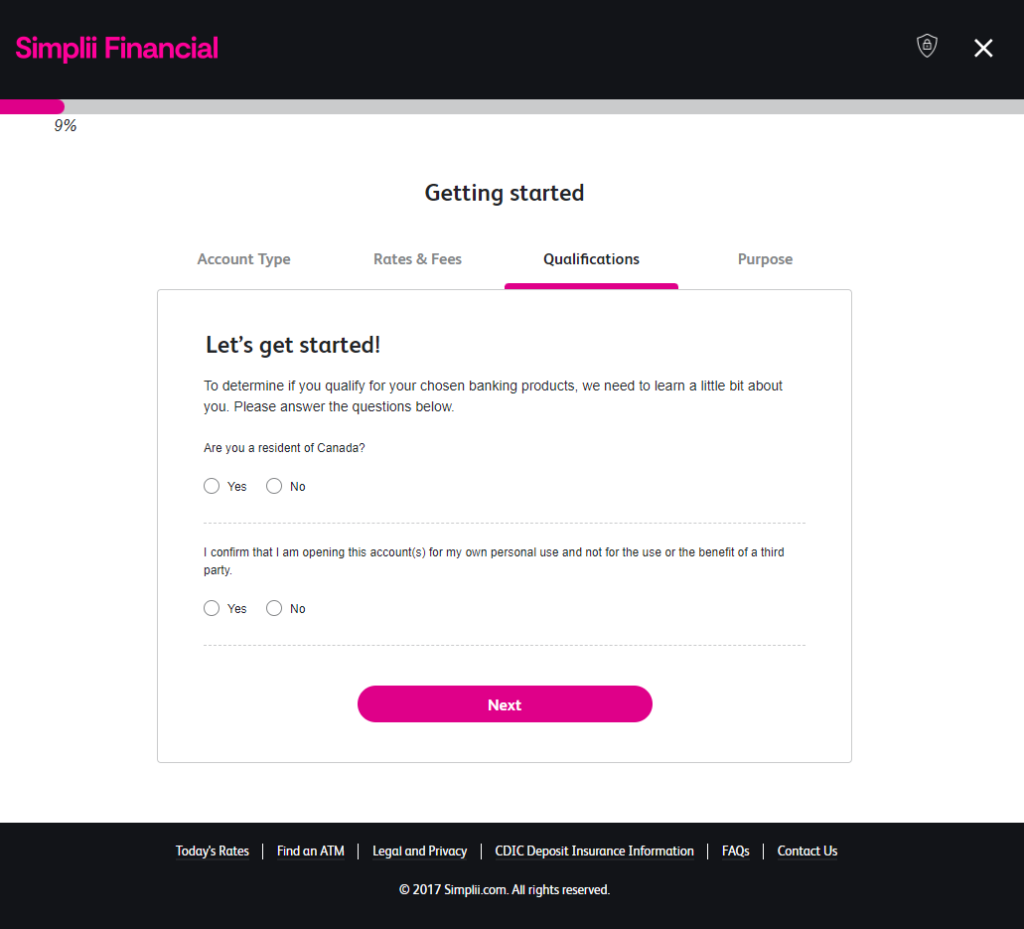

2. Answer a few questions to make sure you are qualified

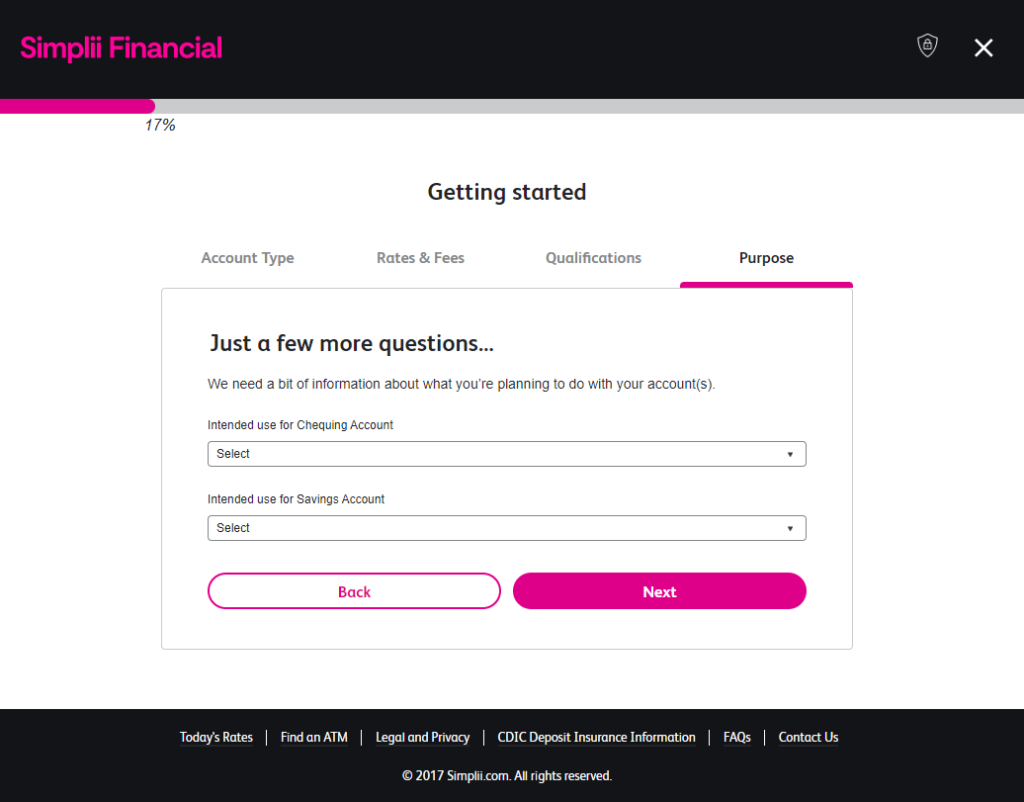

3. Answer some more screening questions

a) I chose Expenses (Household/Family) for Chequing and Emergency Fund for Savings

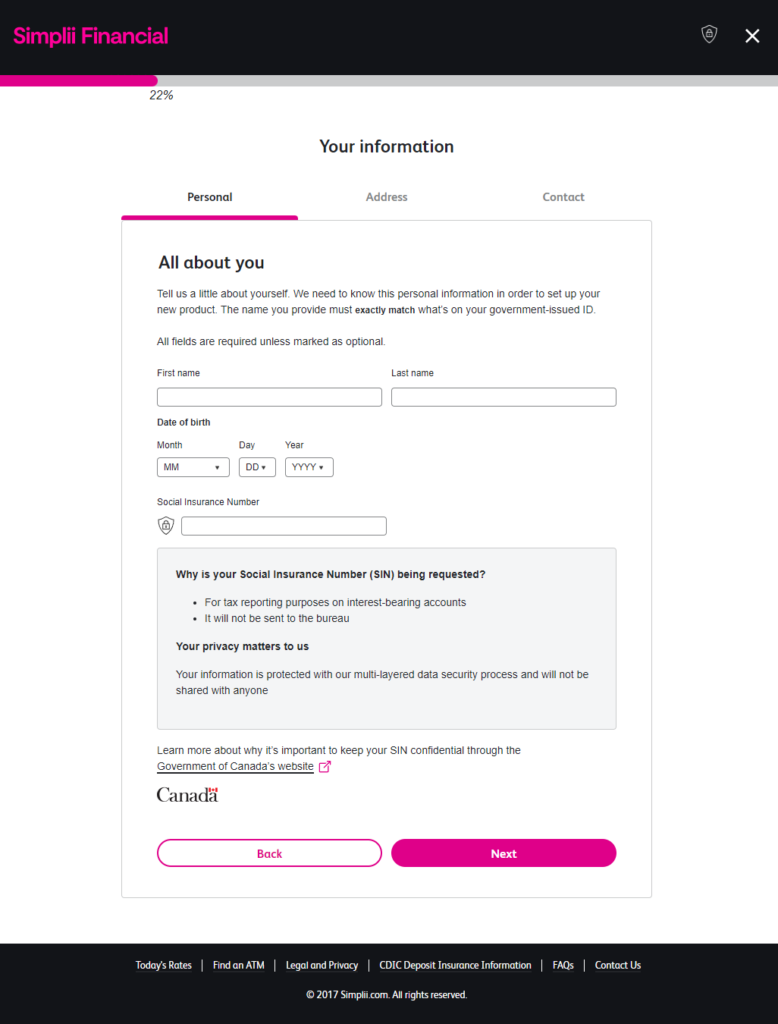

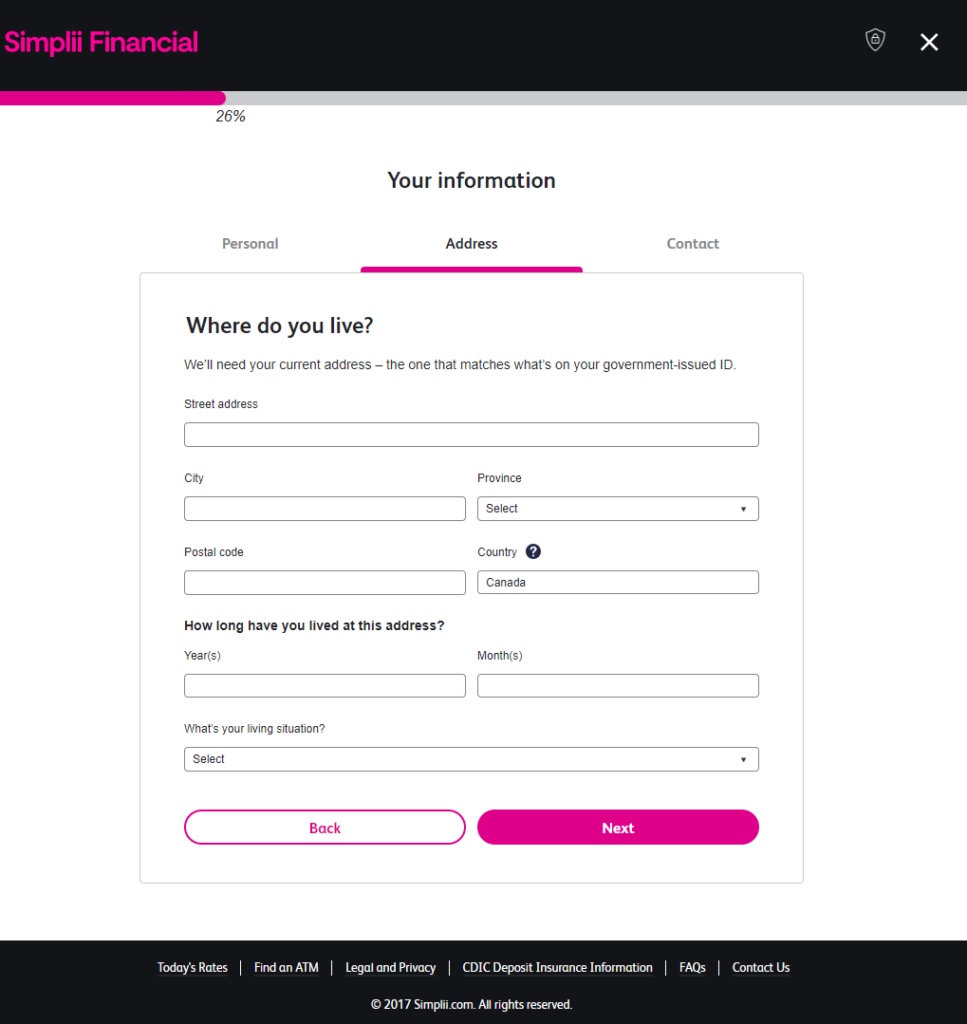

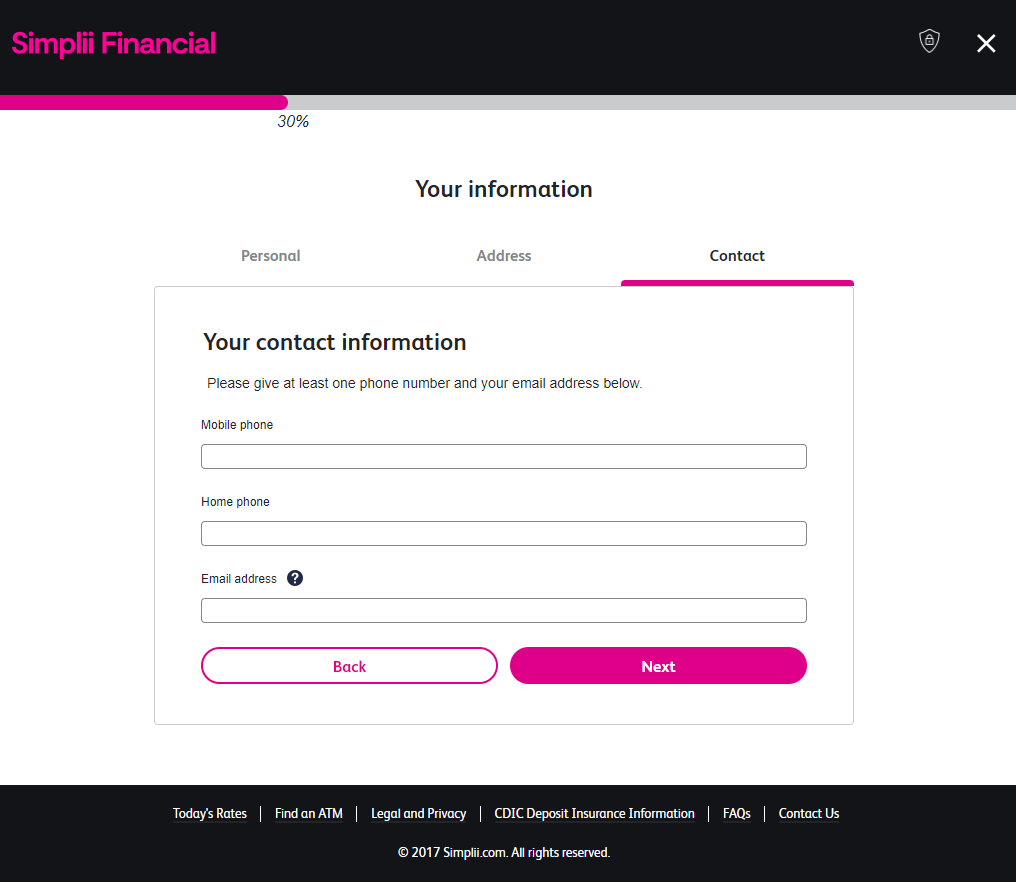

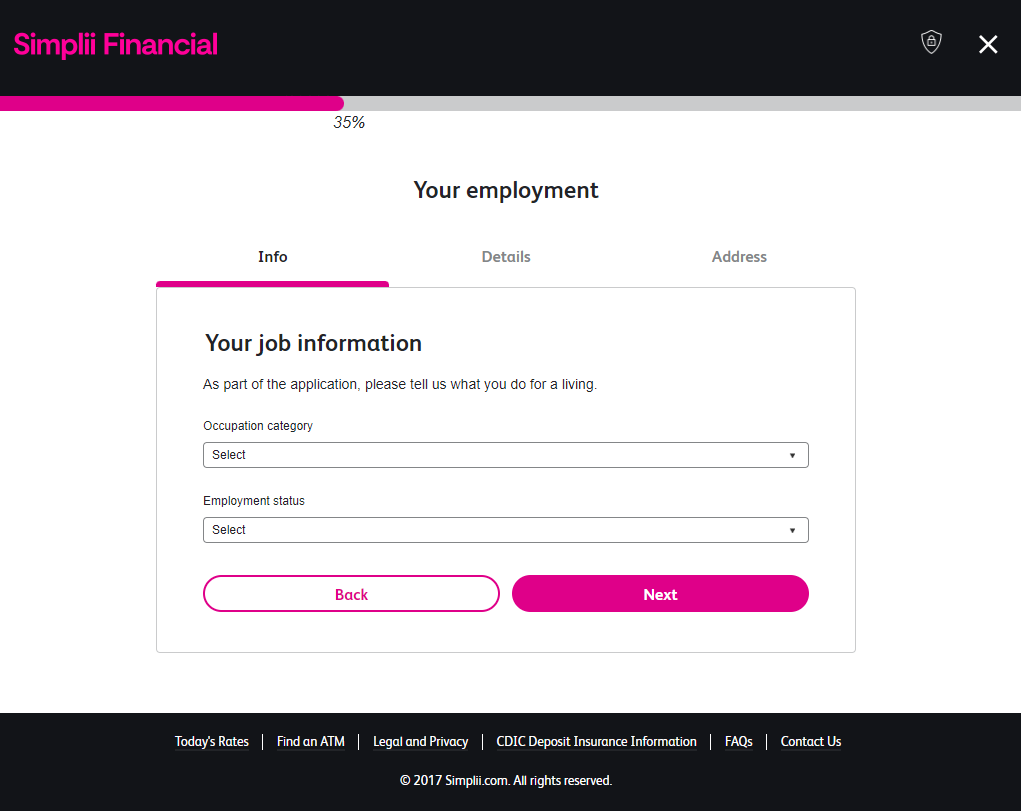

4. Provide personal information

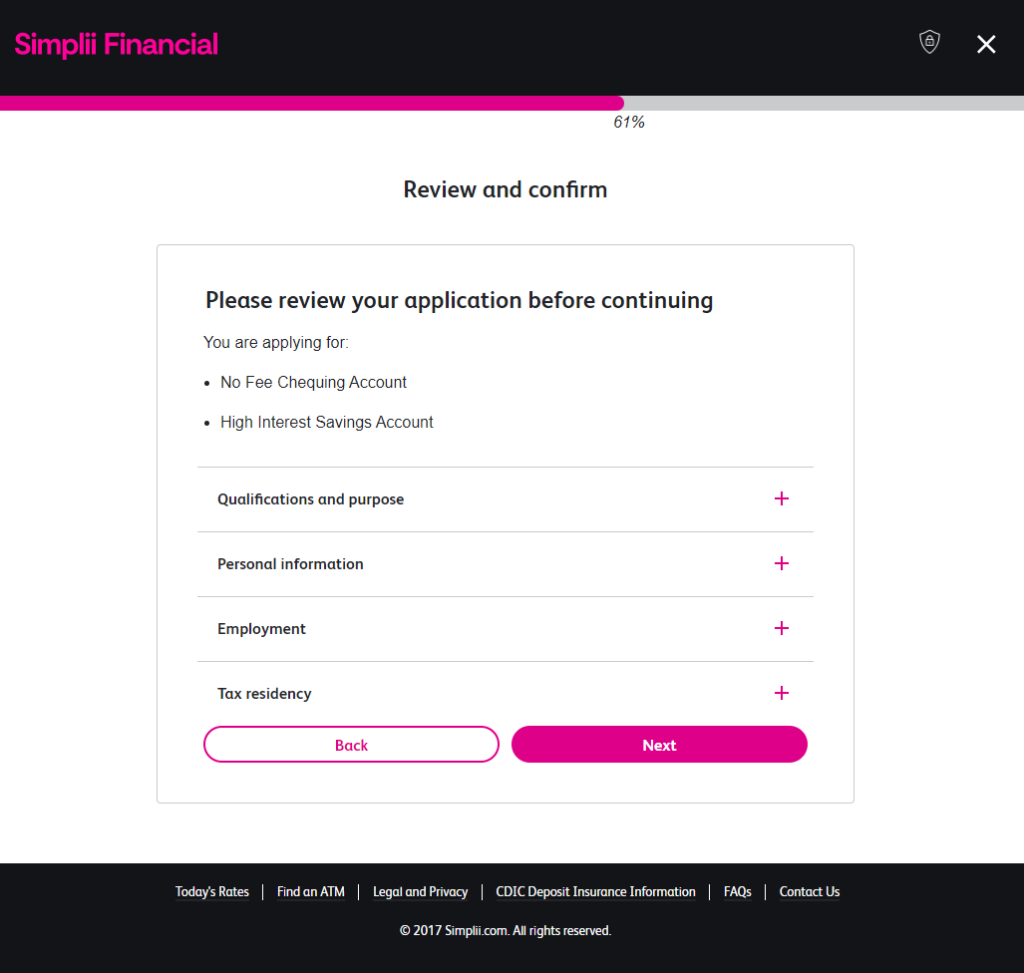

5. Review and confirm your information

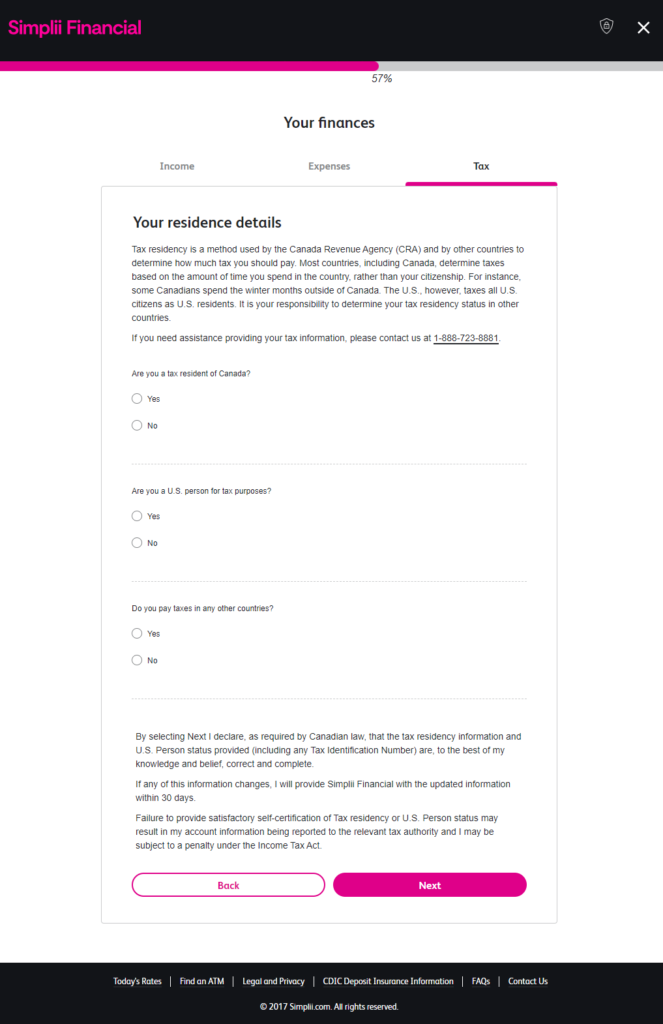

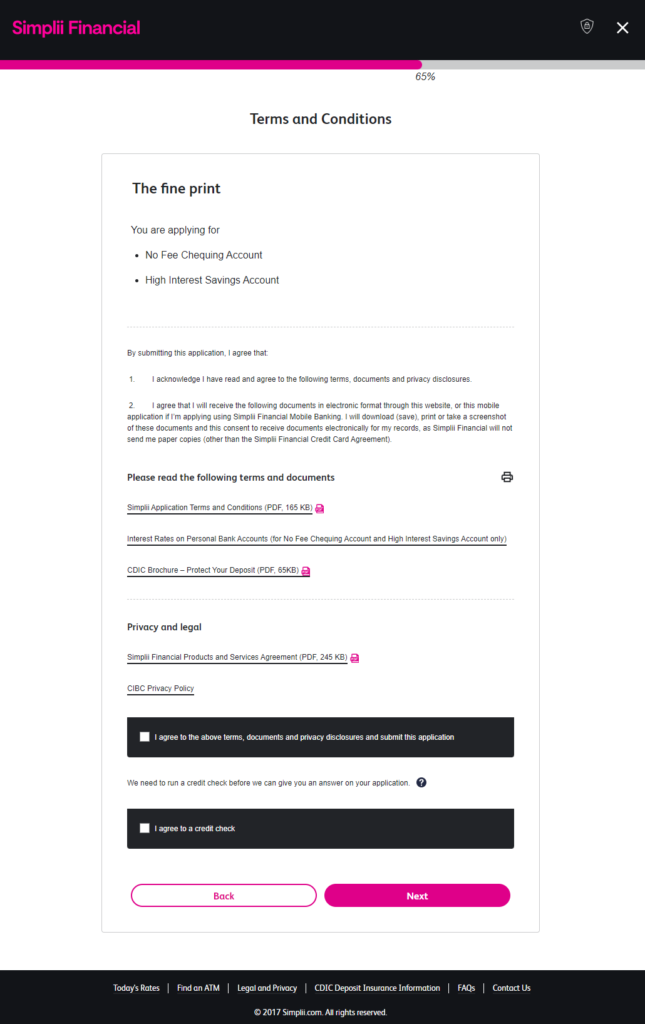

6. Read and agree to the terms and conditions

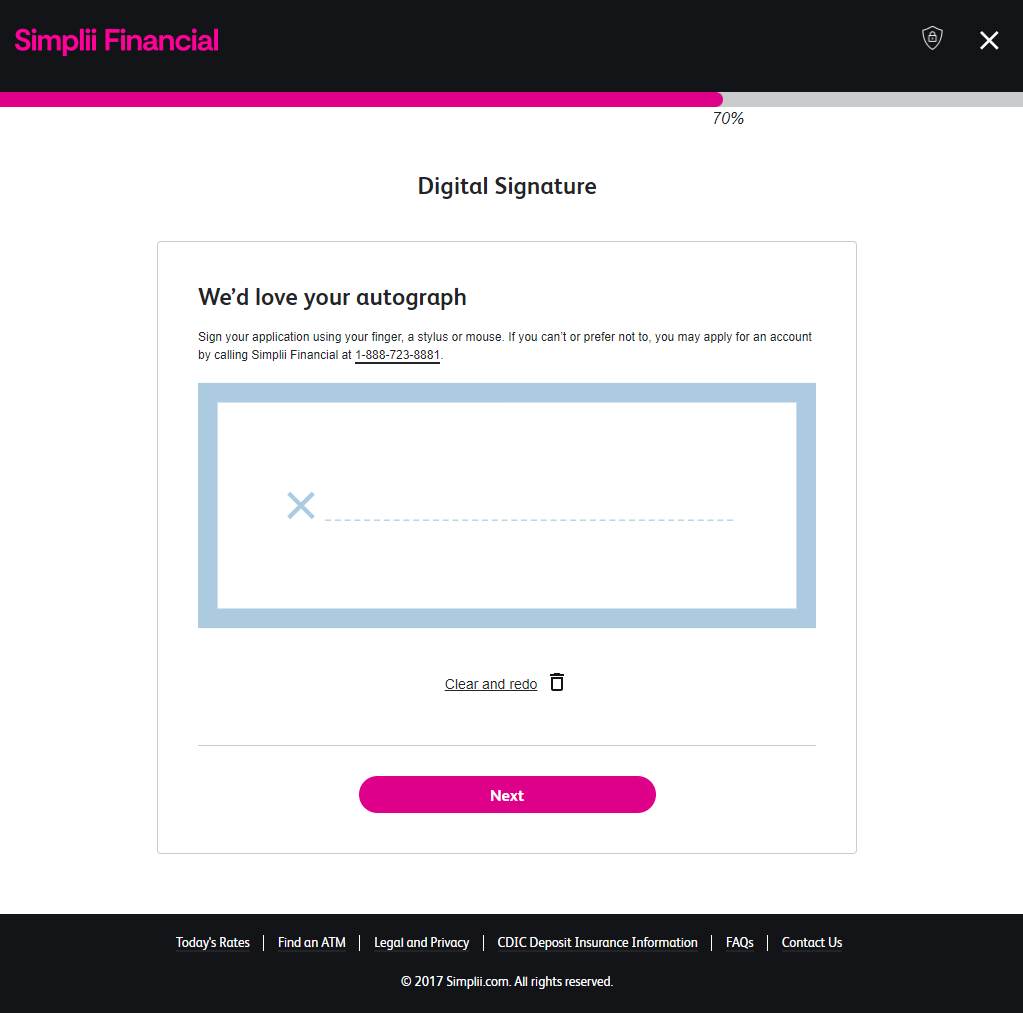

7. Digitally sign the application

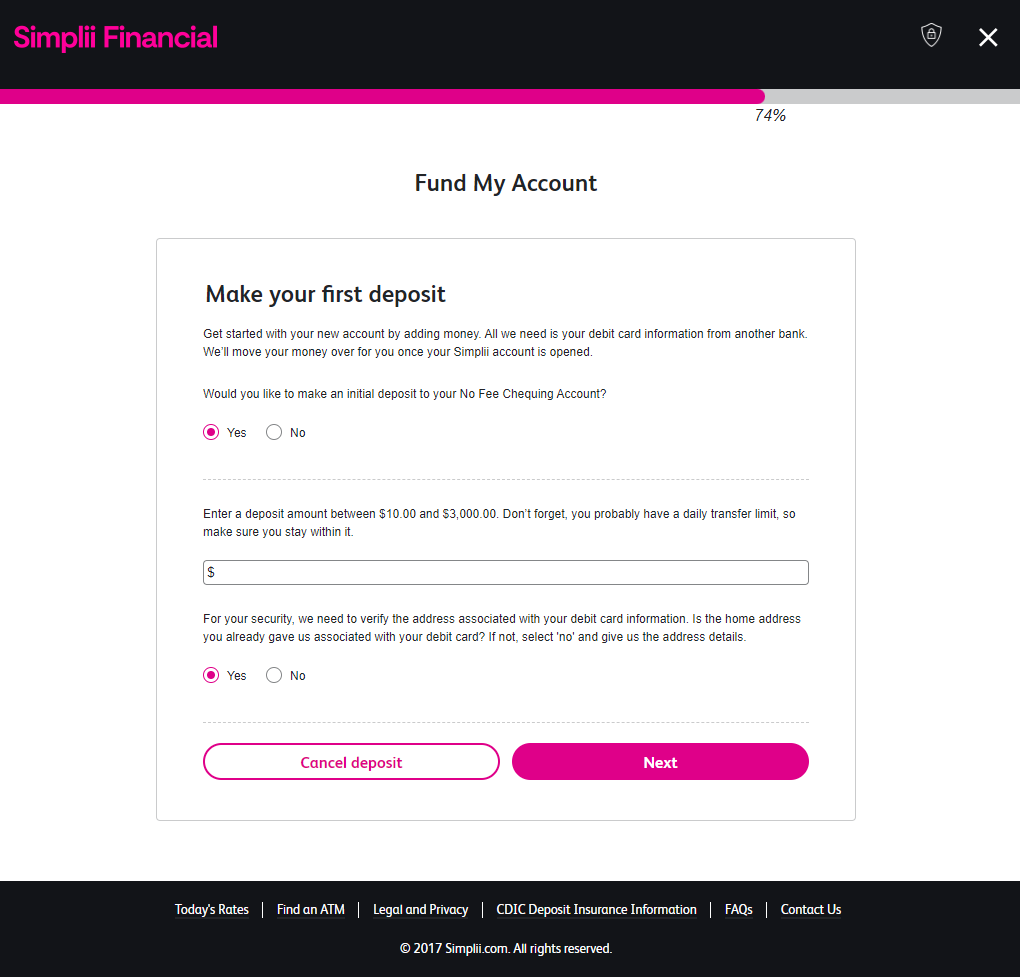

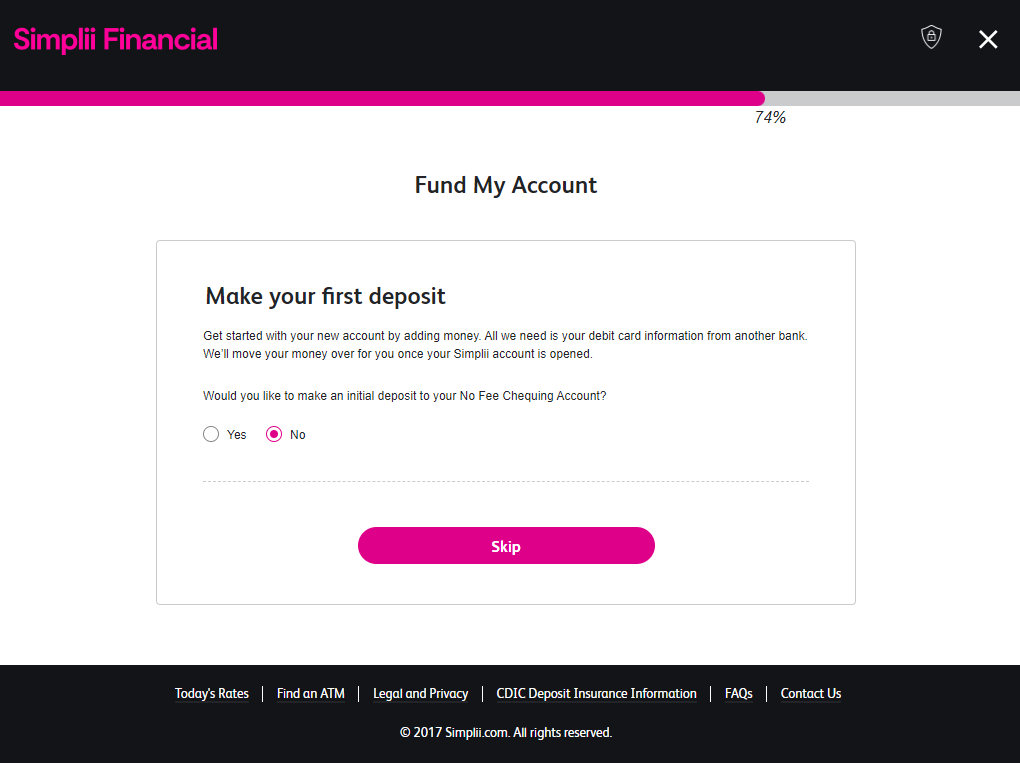

8. Choose to fund the account or skip

I chose to skip this process. If you skip this step, you will not be able to fund your account until you receive your debit card in the mail and register for online banking or use your card at an ATM

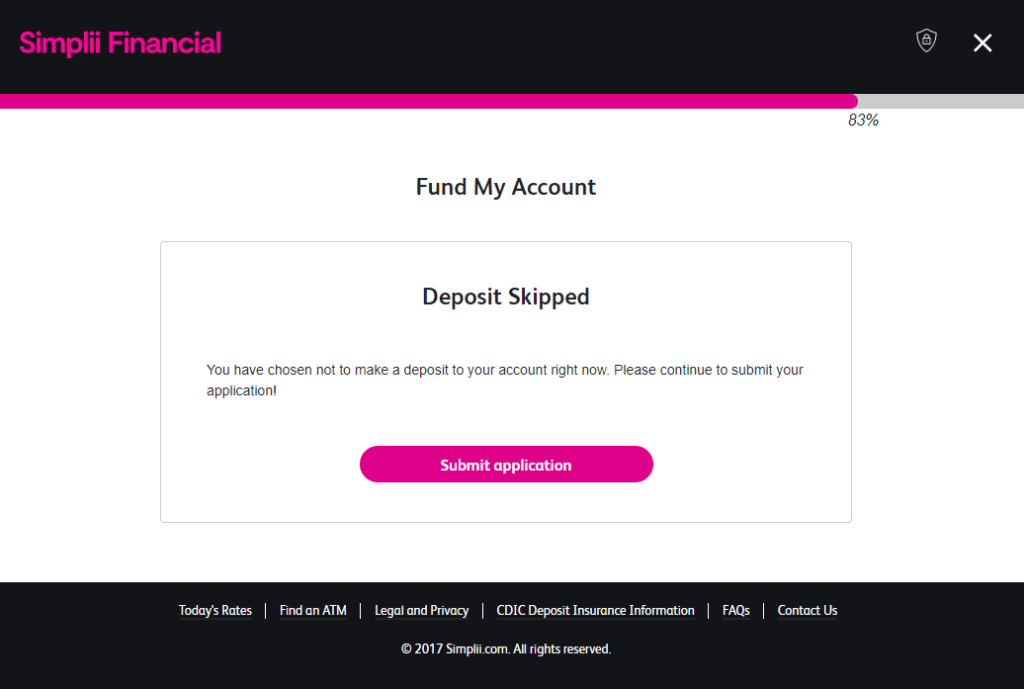

9. Submit your application

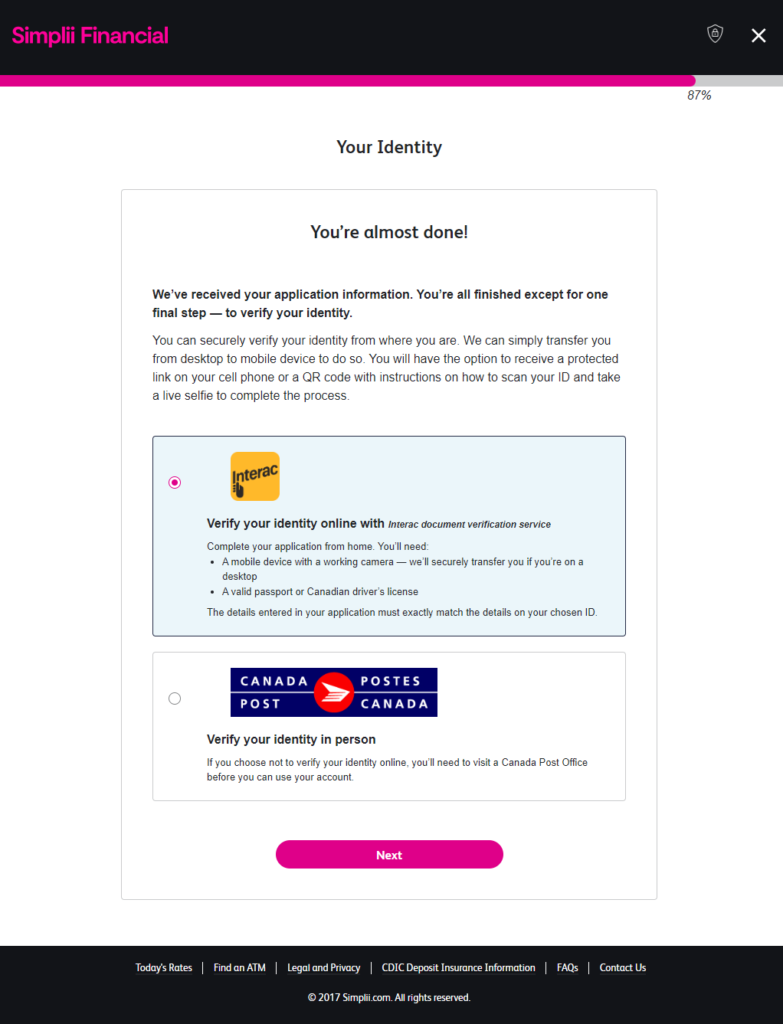

2. Verify your identity

If you choose to do it at home, choose the Interac option which will take you to another page that explains the verification steps. You will need to take a picture of your ID and take a selfie. You will need a mobile device with a camera if you are on the desktop computer.

Alternatively, you can choose to verify your identity at a Canada Post office.

3. Wait for confirmation email and debit card in the mail

If all went well, you will get a confirmation page telling you that your application has been completed and to keep an eye out for an email with more details and next steps.

I recevied an email later that night with details about the promotional offer. Since it did not contain the information for registering and signing into my new account, I still had to wait for the debit card in the mail.

4. Register for online banking

Once you receive your debit card in the mail, you will need the register for online banking to access your accounts.

To register:

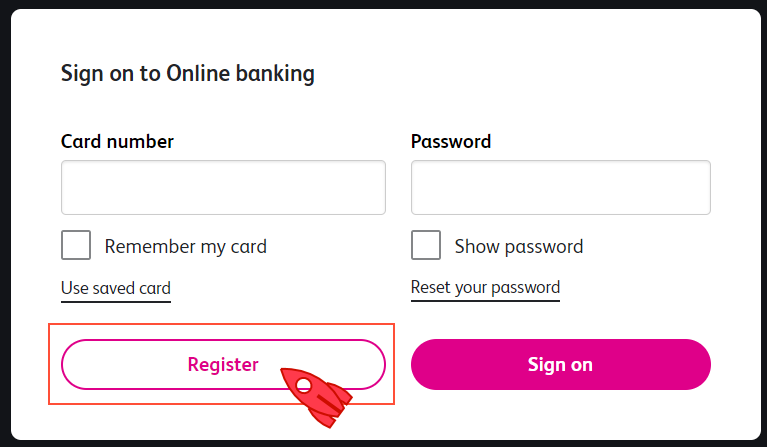

- Click on Sign On on the Simplii Financial page

- Click Register

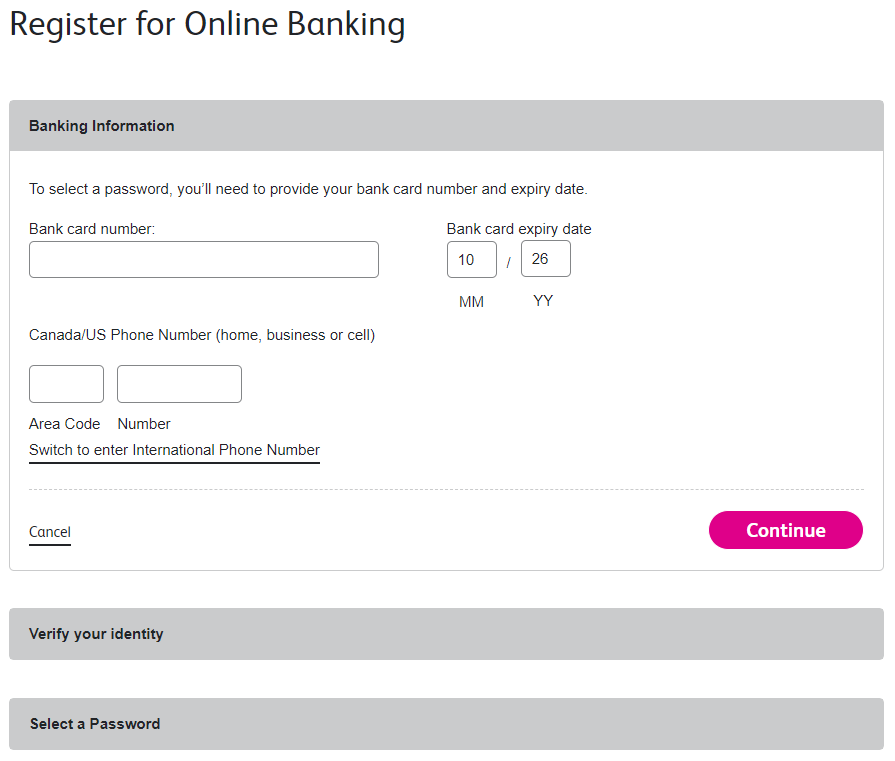

- Input your bank card number, expiry date, and your phone number

- Verify your identity

- Select a password

Final Thoughts

Overall, opening accounts at Simplii Financial is easy and fast. The steps are well described and straightforward.

Their no-fee chequing and high-interest savings accounts are ideal for people who:

- don’t want to pay monthly banking fees (who does?)

- want to take advantage of their high promotional interest rates

- don’t mind doing their banking online

Disclosure: Capital Rocket is an independent website and we do our best to provide accurate and useful information. The information provided should not be considered advice or an endorsement. Some content may include affiliate links, which means we may earn a small commission at no additional cost to you. Please review our disclaimer for more details.